The Chinese Bank Card Clearance Market is Opening: What's Next?

2015-06-17

The Chinese Bank Card Clearance Market is Opening: What's Next?

Ding Liang, Wu Jia

On April 22, 2015, the Chinese State Council published new rules concerning the bankcard clearance market. [1] From June 1 of 2015, the bankcard clearance market is open to international bankcard organizations,domestic third-party payment institutions and qualified banks. The rules end the history of China Union Pay ("CUP") as the only bankcard organization that provides cross-bank RMB currency clearing service in mainland China, and will encourage the competition to raise the level of bankcard clearing service.

1. Bankcard Clearing Business

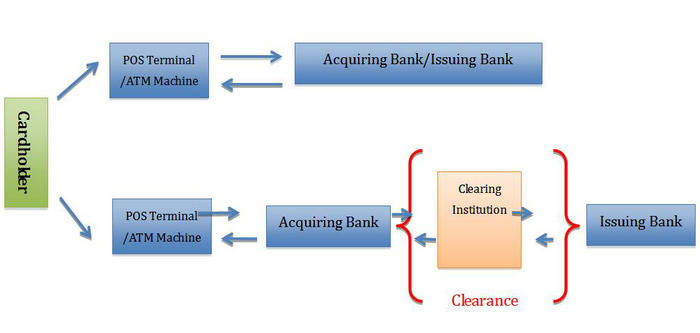

The chart shows the standard clearing process of inter-bank transaction and cross-bank transaction.

Clearing institutions are not usually involved in inter-bank transaction where the acquiring and issuing banks are the same. On the other hand, clearing institutions are essential for cross-bank transaction. For example, the POS terminal of one bank can accept bankcards from other banks because the clearing institution is working behind the cross-bank transaction.

So far, CUP has been the only bankcard clearing service provider in clearance market. Based on their present business model, when the merchant uses the POS terminal a relevant handling fee is collected and allocated proportionally among the card issuing bank, card acquiring bank and CUP.

The clearing service levies a fee, which makes the market attractive to international card organizations, domestic third-party payment institutions and the banks. Even more so as swiping your bankcard becomes an increasingly popular method of consumption in China. The statistics shows that, by the end of 2014, almost 5 billions bankcards had been issued. During 2014 bankcard transactions occurred almost 60 billion times, transferring RMB 449,900 billion: almost 50% of the total commodities sales in the country.

2. The Voice from the International Bankcard Organization

On September 15, 2010,United States resorted to the WTO dispute resolution procedure on the subject of the Chinese electronic payment service, alleging that China violated the open promise of an electronic payment services market and did not allow U.S. credit card companies the national treatment as domestic clearing institutions, as required by GATS. The United States asserted that CUP enjoyed the following treatments in the territory of China:

CUP Logo: each RMB payment bankcard shall be identified with CUP logo;

Connecting Requirement: each card issuing bank in China and each bankcard with the CUP logo shall be connected into the net of CUP;

Terminal Requirement: all domestic bankcard handling equipment, ATM machines and POS terminals in the territory of China shall be compatible with or able to accept the CUP logoed bankcards;

Card Acquiring Bank Requirement: each card acquiring bank shall be identified with the CUP logo and be the member of CUP association and shall be able to accept any bankcard with CUP logo.

On July 16, 2012, the Panel released its decision. It held that:

CUP logo: Requiring the CUP logo changed the competition condition and raised the popularity of CUP, resulting a less favorable treatment to the service providers from other WTO member countries;

Connecting Requirement: this requirement changed the competition condition by assuring each commercial bank be a member of CUP association, resulting a less favorable treatment to the service providers from other WTO member countries;

Terminal and Card Acquiring Bank Requirement: the requirement changed the competition requirement, favoring the CUP logoed bankcard such that it be accepted by the commercial banks and the commercial terminals, which resulted in a less favorable treatment to the service providers from other WTO member countries;

After the decision from the panel, the Chinese government took adjustment measures. This case reflected the focus of international bankcard organizations and accelerated a change in the Chinese bankcard clearance market.

3. The Rise of Domestic Third-party Payment Institutions

Alipay is a leading company in the field of domestic online payment. Its strategy is not limited to the online payment market. Early in 2012, Alipay prepared to enter the offline payment industry and prepare da logistics POS terminal payment plan. However, in August 2013, Alipay disclosed without any previous suggestion that it would cease their POS terminal business "due to certain reason that everyone knows", implying problems with competing with Union Pay.

According to Article 3(2) of the above rule, the bankcard clearing institution shall not limit the cooperation between the card issuer and the card acquirer and other bankcard clearing institutions. This offers the opportunity and the policy support for Alipay to enter the bankcard clearing market.

4. Future Trends

The Handling Fee Might Be Adjusted

The bankcard clearing market is a two-sided market, on one side, the card issuing market is comprised of the card issuing banks and the cardholders, on another side, the card acquiring market is compromised of the card acquiring banks and the merchants. The issuing bank, clearance institution and the acquiring bank are responsible for their own functions as part of the broader chain. Freeing up the chain may lead to changes in prices.

According to the Notice of Optimizing and Adjusting Handling fee of Swiping Bankcard published by NDRC, the current handling fees areas follows:

Merchant Classifications | Service fee charged by the card Issuing Bank | Internet Service Fee charged by the Bankcard Clearing Institute | Acquiring Service Fee Base Price |

1.Restaurants and Entertainments:Restaurants, hotels, entertainments, jewelers, arts and crafts, real estate and car sales | 0.9%, each fee in real estate and car sale is capped at 60 RMB | 0.13%, each fee in real estate and car sale is capped at 10 RMB | 0.22%, each fee in real estate and car sale is capped at 10 RMB |

2.General:Department, wholesale, social training, agent service, travel agency, ticket for tourist attraction, and etc. | 0.55%, each fee in wholesale is capped at 20 RMB | 0.08%*X; each fee in wholesale is capped at 2.5 RMB | 0.15%, each fee in wholesale is capped at 3.5 RMB |

3.Well-beings of citizens: supermarkets, large-size stores with inventory, water,gas, electricity chargings, gas stations, transportations | 0.26% | 0.04% | 0.08% |

4.Pulic benefits:public hospitals and public schools | 0 | 0 | Based on the service costs |

Note:

A single restaurant with the business area under 100 m2 shall be treatedunder the General classification;

For unlisted industry, it shall be treatedunder the General classification;

Acquiring service fee standard is a base price, in practice, it can fluctuate up and down by 10%

Online Payment might be the Competition Focus in the Next Phrase of market development

Because the online payment industry develops quickly, both overseas and domestic bankcard organization may gradually focus their attention to the online payment field.

Based on reported statistics by iResearch, Chinese mobile transactions in 2014 were RMB 213 trillion. It is forecast that in 2018, this amount may rocket to RMB 1,000 trillion. Compared to the offline credit card clearing market, the online payment industry lacks definite and clear competition rules. It is possible that competition issues may arise among the international bankcard organizations, domestic third-party payment institutions and the banks. We will keep close attention to the legislature and the practice of this freshly growing industry.

[1]State Council’s Determination re Implementing the Threshold Management of Bankcard Clearing Institutions